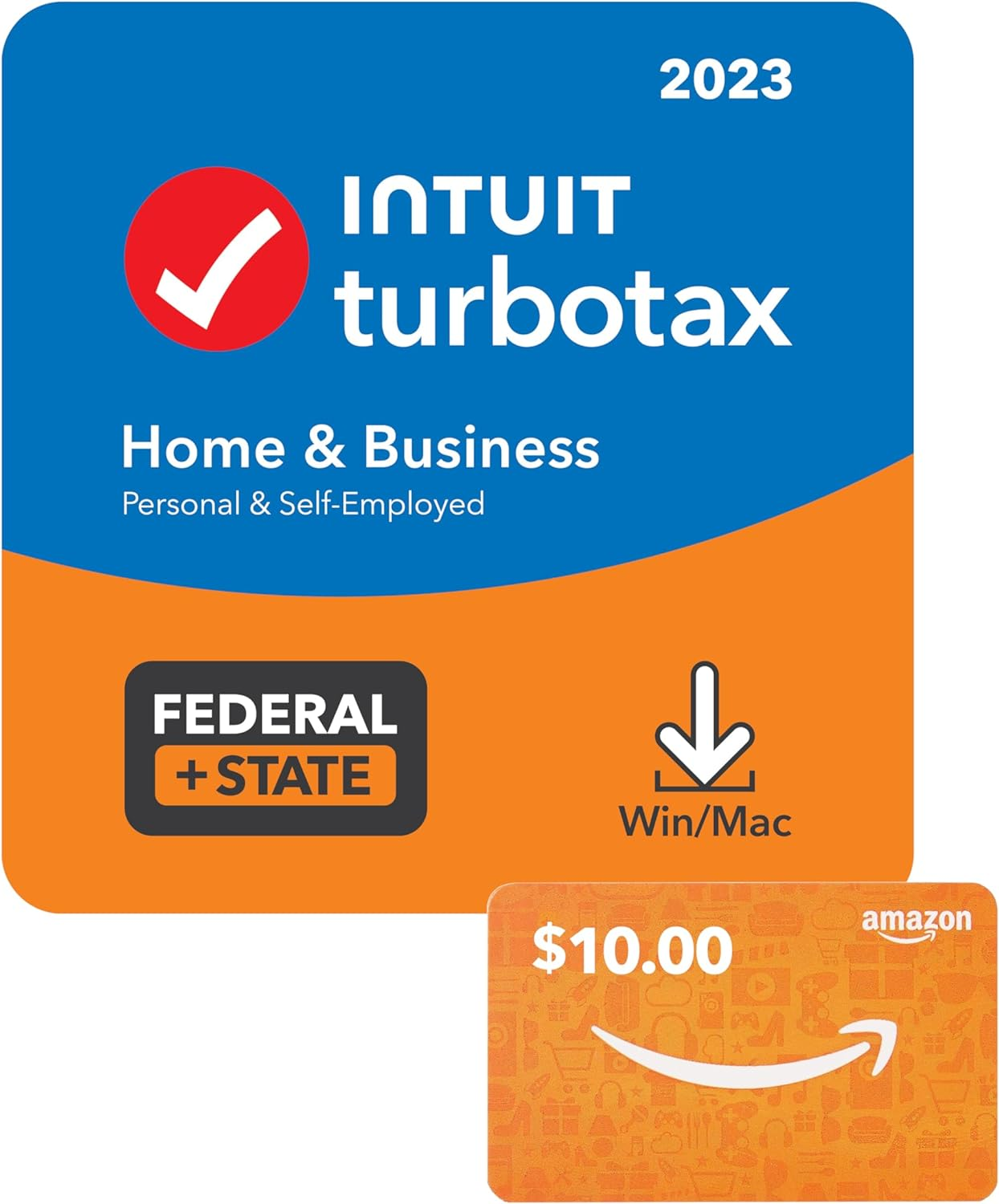

Ready for tax season? We found the cheapest deal of the year for TurboTax!

Just select the TurboTax gift card bundle here, and get a $10 Amazon gift card – TODAY ONLY! It’s the same price as Costco/Sam’s Club except that you also get an Amazon gift card. IT’S TODAY ONLY. Use this link to get the grab this deal TODAY! Did I mention it’s only today?

Get $10 Amazon Gift Card with select TurboTax bundle purchase!

TurboTax is a helpful tax preparation service made by Intuit. Their program asks you questions about your money, and then puts the answers on the right tax forms. OR you can have an expert do your taxes. Calculations are 100% accurate either way you do it, as guarantee by TurboTax.

Here are some things TurboTax does:

- User-Friendly Interface: TurboTax is designed to be intuitive and easy to use. The software asks users a series of questions to gather relevant information and then uses that data to fill out the appropriate tax forms.

- Guided Interview Process: TurboTax employs a step-by-step interview process to collect information about the user’s financial situation. This process is designed to identify potential deductions and credits that may apply to the user’s specific circumstances.

- Importing Financial Data: TurboTax allows users to import financial data directly from sources like W-2 forms, 1099s, and other financial institutions. This feature helps minimize data entry errors and saves time.

- Error Checking and Accuracy: The software includes built-in error checking to help users identify and correct potential mistakes in their tax return. This feature is crucial for ensuring accurate and compliant tax filings.

- Deduction and Credit Maximization: TurboTax helps users identify potential deductions and credits to maximize their tax refund or minimize the amount owed. This includes deductions for education expenses, homeownership, business expenses, and more.

- Access to Tax Professionals: TurboTax offers different versions, including options for individuals, self-employed individuals, and businesses. Some versions provide access to tax professionals for additional assistance and advice.

- Electronic Filing (e-filing): TurboTax supports electronic filing, allowing users to submit their tax returns to the IRS and state tax authorities securely. E-filing is generally faster and more convenient than traditional paper filing.

- Audit Support: TurboTax offers assistance in the event of an audit. While the level of support varies depending on the version of the software, some versions provide access to professionals who can guide users through the audit process.

Comments